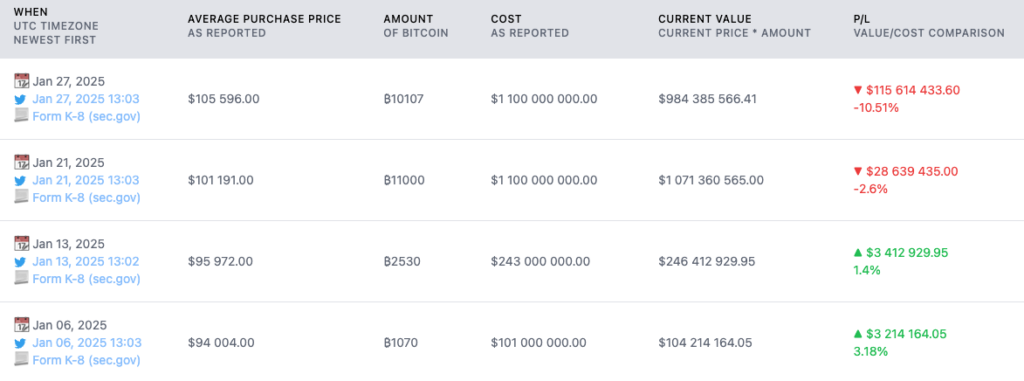

Bitcoin-focused corporate entity Strategy, formerly known as MicroStrategy, has completed its first Bitcoin acquisition since rebranding last week. The firm purchased 7,633 BTC between February 3 and February 9, 2025, at an average price of $97,255 per Bitcoin, according to an SEC Form 8-K filing released on Monday.

Strategic Rebranding and Continued Bitcoin Accumulation

The purchase follows the company’s official rebranding to Strategy on February 5, underscoring its continued commitment to a Bitcoin-focused corporate treasury strategy. Since first entering the Bitcoin market in August 2020, Strategy has steadily increased its holdings, now owning a total of 478,740 BTC, acquired at an average cost of $65,033 per BTC.

The move aligns with the company’s long-term vision of utilizing Bitcoin as a strategic reserve asset, further solidifying its reputation as the largest corporate holder of Bitcoin.

Bitcoin Yield and Financial Performance

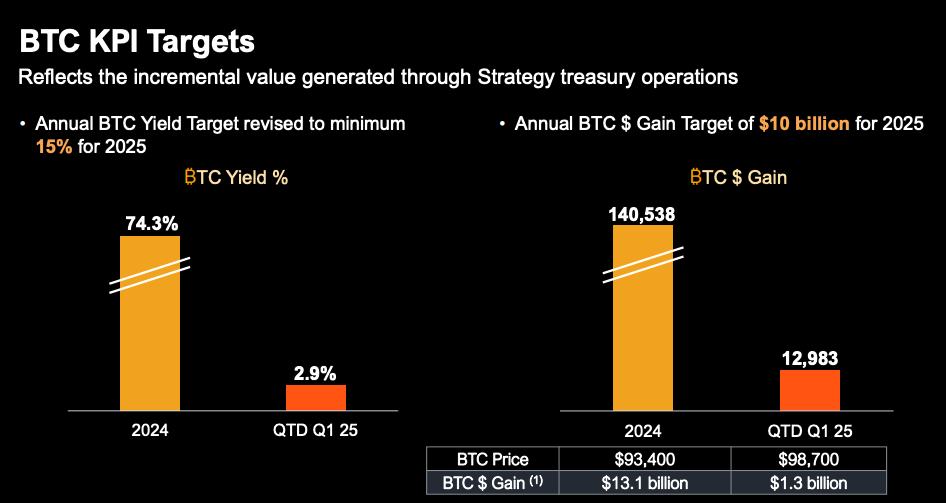

According to the filing, Strategy’s Bitcoin yield, a key performance metric measuring the percentage change in the ratio between BTC holdings and assumed diluted shares, reached 4.1% year-to-date (YTD) as of February 9, 2025.

The company had previously reported a Bitcoin yield of 74.3% for 2024, but revised its 2025 target downward following a $670 million net loss in Q4 2024. For the current year, Strategy is aiming for a 15% BTC yield, reflecting a more measured approach amid ongoing market fluctuations.

Additionally, the firm’s Bitcoin gains from January 1 to February 9 totaled approximately $1.8 billion, representing a nearly 18% increase from its $10 billion targeted gains for 2025. By comparison, in 2024, Strategy recorded a total Bitcoin gain of 140,538 BTC, valued at $13.1 billion.

Growing Bitcoin Reserves and Capital Strategy

With the latest acquisition, Strategy’s Bitcoin purchases in 2025 have reached 32,340 BTC, accounting for about 7% of its total holdings. The firm continues to fund its Bitcoin acquisitions through proceeds from the issuance and sale of shares under a convertible notes sales agreement.

As part of its “21/21 Plan”, Strategy intends to raise up to $21 billion in equity and $21 billion in fixed-income securities over the next three years to expand its Bitcoin reserves. This ambitious strategy reflects the company’s long-term vision of integrating Bitcoin into its corporate financial structure.

Industry Recognition and Strategic Positioning

Founded by Michael Saylor in 1989, Strategy has evolved into what it calls the “world’s first and largest Bitcoin Treasury Company.” The rebrand coincides with growing support among U.S. lawmakers for the adoption of a strategic Bitcoin reserve, further cementing the asset’s role in corporate finance.

Commenting on the company’s new identity, Jan3 CEO Samson Mow emphasized that the shift aligns with its overarching strategy.

“There’s nothing micro about what MicroStrategy is doing, so the rebrand to Strategy is very fitting,” Mow stated in a recent interview.

The company’s continued Bitcoin accumulation, coupled with its aggressive capital-raising initiatives, signals a steadfast commitment to its Bitcoin-first approach, reinforcing its position as a leader in corporate Bitcoin adoption.